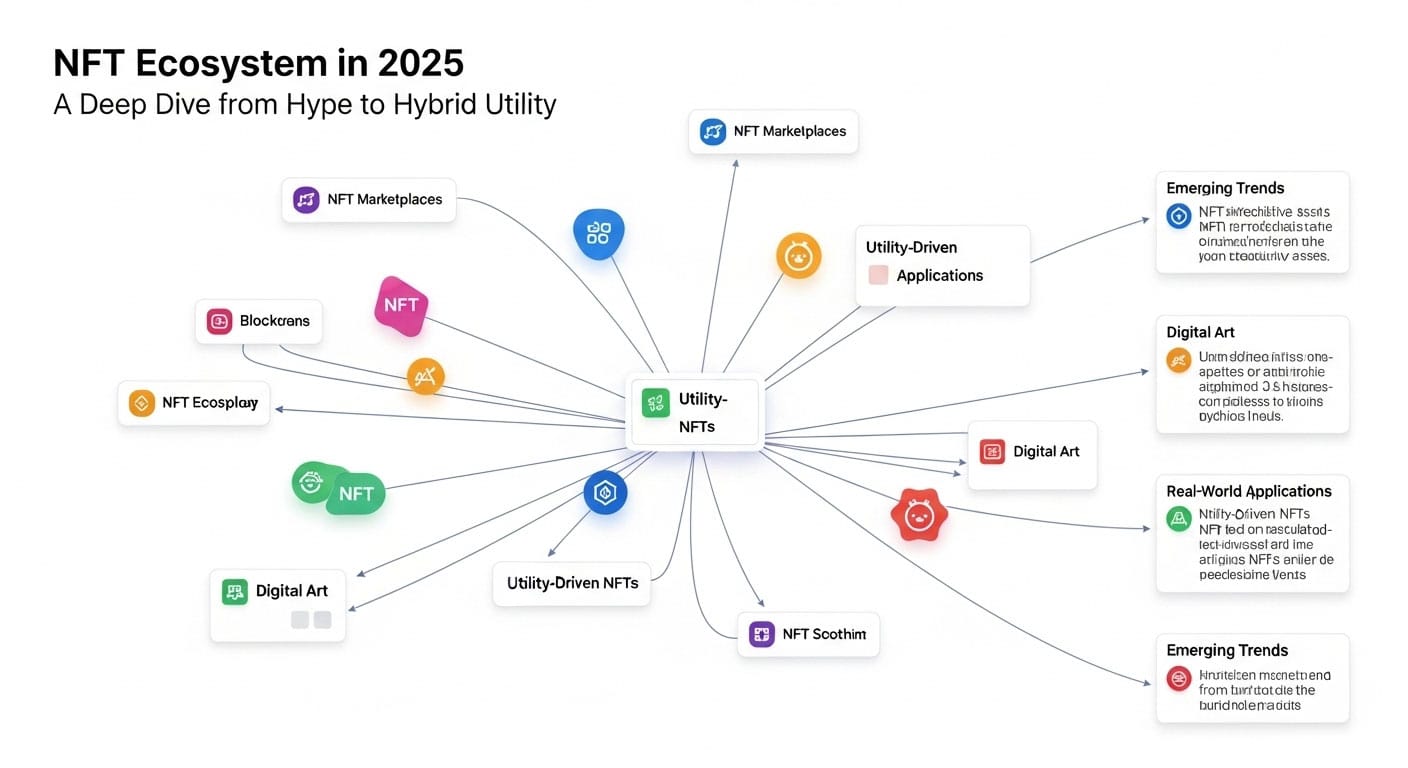

The Non-Fungible Token (NFT) market in 2025 represents a resilient and rapidly maturing landscape. After navigating intense volatility, the speculative frenzy of 2021-2022 has given way to a more sustainable foundation defined by a decisive shift towards real-world utility. Growth is no longer solely fueled by digital art and collectibles but by NFTs that provide tangible value, such as verifiable ownership of in-game assets, tokenized real-world assets (RWAs), and innovative fan engagement models. Navigating the NFT ecosystem in 2025 requires understanding this fundamental pivot from hype to tangible, hybrid value.

This article provides a comprehensive analysis of this evolving landscape, offering strategic insights for creators, investors, and businesses by examining the market’s technical foundations, economic performance, key use cases, and the critical legal challenges that lie ahead.

The Foundational Layer: Understanding NFTs, Blockchains, and Smart Contracts

To grasp the current market, it’s essential to understand the core technology. NFTs are unique cryptographic assets on a blockchain that serve as a digital certificate of ownership for a specific item, making digital scarcity a reality.

What is a Non-Fungible Token?

- Core Definition: An NFT is a unique, unrepeatable digital asset on a blockchain. Unlike a dollar or Bitcoin (fungible), each NFT is distinct and cannot be interchanged on a 1:1 basis.

- Key Characteristics: NFTs are unique, indivisible, easily transferable, and their authenticity and scarcity are verifiable on a public ledger.

- What an NFT Represents: Crucially, an NFT is typically a pointer or certificate that links to a digital asset (like a JPEG or MP4) stored elsewhere, often on decentralized systems like IPFS to prevent link rot. Owning the token does not automatically grant copyright or IP rights to the underlying asset.

The Technological Backbone: Blockchain and Smart Contracts

Blockchain technology provides the decentralized, secure, and transparent ledger that makes NFTs possible. Smart contracts are the self-executing programs that govern every aspect of an NFT’s life.

- Smart Contract Functions: They manage an NFT’s creation (minting), enforce its uniqueness, track ownership, and automate transfers. A revolutionary feature is the ability to program automatic creator royalties for every secondary sale.

- Dominant Token Standards: The choice of token standard is a strategic decision that impacts a project’s cost, efficiency, and capabilities.

| Feature | ERC-721 | ERC-1155 | Key Advantage/Use Case |

|---|---|---|---|

| Token Support | Non-Fungible Tokens (NFTs) only | Fungible, Semi-Fungible, and NFTs | ERC-1155 offers superior flexibility for complex ecosystems like games. |

| Batch Transfers | No. Each token is transferred individually. | Yes. Multiple token types in a single transaction. | ERC-1155 dramatically reduces gas fees and network congestion. |

| Gas Efficiency | Less efficient, especially for multiple mints. | Highly efficient due to batch operations. | The cost-effective choice for high-volume projects. |

| Ideal Use Cases | Digital art, high-value 1-of-1 collectibles. | Gaming, loyalty programs, large collectible sets. | Matches the standard to the project’s functional needs. |

While Ethereum remains dominant, high fees have spurred the growth of alternatives like Polygon (Layer-2), Solana (high-speed), and Bitcoin (via Ordinals), creating a fragmented, multi-chain landscape.

The Creation Process: How to Mint an NFT in 2025

Minting is the process of converting a digital file into a crypto asset on the blockchain. Thanks to user-friendly platforms and new technologies, this process is more accessible than ever.

A Practical Guide to Minting

- Prepare the Digital Asset: Start with your creation (image, video, audio). AI-powered tools like AI NFT Generator have lowered the barrier, allowing anyone to create art from text prompts.

- Choose a Blockchain: Decide between established networks like Ethereum or cost-effective alternatives like Polygon or Solana based on your project’s needs.

- Set Up a Crypto Wallet: A non-custodial wallet like MetaMask or Phantom is needed to pay fees and store your NFT.

- Select a Marketplace: Choose a platform like OpenSea (for broad access), SuperRare (for curated art), or a specialized platform.

- The Minting Transaction: Upload your file, fill in the metadata (name, description, traits), set your creator royalty percentage, and approve the transaction in your wallet.

The Economics of Creation: Gas Fees and “Lazy Minting”

Gas fees are transaction fees paid to network validators. They are highly volatile and influenced by network congestion and transaction complexity. To combat high costs, the ecosystem has developed several solutions:

- Timing Transactions: Minting during off-peak hours can significantly reduce costs.

- Using Layer-2s and Alt-Chains: Platforms like Polygon offer dramatically lower fees than the Ethereum mainnet.

- Lazy Minting: A game-changing feature where the NFT is only minted on the blockchain when the first purchase occurs. This shifts the gas fee from the creator to the buyer, eliminating upfront financial risk for artists and enabling “free-to-mint” project models that focus on secondary market royalties for revenue.

Market Analysis and Economic Outlook for 2025

The economic outlook for the 2025 NFT market is one of robust recovery and a structural shift towards utility-driven value, marking a new phase of maturity.

Market Performance and Projections

After a severe downturn in Q1 2025, where sales plunged over 50% to just $1.05 billion, the market demonstrated remarkable resilience. Q2 2025 marked a significant turning point with a strong recovery, driven by the growing adoption of Real-World Asset (RWA) and gaming NFTs. This rebound indicates the market’s health is increasingly tied to sector-specific catalysts rather than broad speculation.

| Year | Market Size (USD Billion) | Key Drivers for the Period |

|---|---|---|

| 2024 (Actual) | $36.23 | Brand adoption, maturation of gaming NFTs. |

| 2025 (Projection) | $48.74 | Strong recovery driven by utility, RWA tokenization, and Web3 gaming. |

| 2034 (Forecast) | $703.47 | Ubiquitous digital ownership and mature regulatory frameworks. |

Key Drivers and Restraints

- Drivers: The shift to utility, mainstream adoption by brands like Amazon and Nike, the growth of high-quality Web3 gaming, and the tokenization of RWAs are propelling the market forward.

- Restraints: Extreme volatility, pervasive security risks (phishing, scams), and significant intellectual property and regulatory uncertainty remain major challenges that temper institutional investment and mass adoption.

The Utility Revolution: Evolving Use Cases in 2025

The future of NFTs is undeniably tied to their real-world utility. The most successful projects are those that offer tangible benefits, access, or rights, creating a bridge between the digital and physical worlds.

Gaming (Play-and-Own)

The gaming sector has evolved from unsustainable “Play-to-Earn” models to more robust “Play-and-Own” economies. The focus is now on high-quality, fun games where NFTs grant players true ownership of in-game assets, allowing them to convert their time and skill into real-world value. Leading titles in 2025 like Illuvium, Big Time, and Shrapnel exemplify this trend.

Tokenization of Real-World Assets (RWAs)

This is arguably the most impactful trend, involving the creation of digital tokens that represent legal ownership of tangible assets like real estate, fine art, or private equity. RWA tokenization increases liquidity for traditionally illiquid assets and enables fractional ownership, making high-value investments more accessible. The critical role of RWAs in the Q2 2025 market recovery highlights their importance.

Other Key Use Cases

- Music NFTs: Empowering artists to sell directly to fans, automate royalties, and even sell fractional ownership of their future streaming revenue.

- Event Ticketing: Combating fraud and scalping with verifiable, unique NFT tickets that can also serve as digital memorabilia and unlock exclusive perks.

- Digital Identity: Using NFTs and non-transferable Soulbound Tokens (SBTs) to create secure, user-controlled digital credentials for degrees, licenses, and other personal achievements.

- Token-Gated Communities: Employing NFTs as a digital key to grant holders exclusive access to online communities, content, and real-world events.

Navigating the Legal and Regulatory Maze

The most significant headwind for the NFT space is the complex and evolving legal landscape. Clarity on intellectual property rights and financial regulation is crucial for long-term stability.

The Intellectual Property Quagmire

A common misconception is that buying an NFT grants the owner the copyright to the underlying asset. In reality, the purchase typically grants a license with specific terms dictating use. This has led to numerous legal disputes. The landmark Hermès v. Rothschild (“MetaBirkins”) case helped establish that trademark laws apply forcefully in the digital realm, prompting brands to be more proactive in protecting their IP.

The 2025 Regulatory Horizon

The central regulatory question is whether certain NFTs should be classified as securities. While a 1-of-1 art piece is unlikely to be a security, fractionalized NFTs or those promising a share of future profits are in a legal gray area. In 2025, there is a discernible shift in the U.S. from “regulation by enforcement” towards establishing clearer legislative frameworks, a move seen as essential for attracting institutional capital and ensuring consumer protection.

The Future Trajectory: A Concluding Outlook

The NFT market of 2025 is an ecosystem in transition, moving from a speculative phenomenon to an integrated layer of our digital economy. The future will be shaped by the convergence of NFTs with AI and the metaverse, where they will serve as the foundational building blocks for digital identity, property, and commerce.

The journey from niche technology to a ubiquitous standard for verifiable ownership is well underway. The innovations and corrections of the past few years have paved the way for a more mature and resilient market. For those who prioritize utility, build strong communities, and navigate the risks with diligence, the NFT ecosystem in 2025 offers a strategic roadmap to the future of digital interaction and value exchange.