This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

World Bank Economy: A Comprehensive Journey through History and Challenges

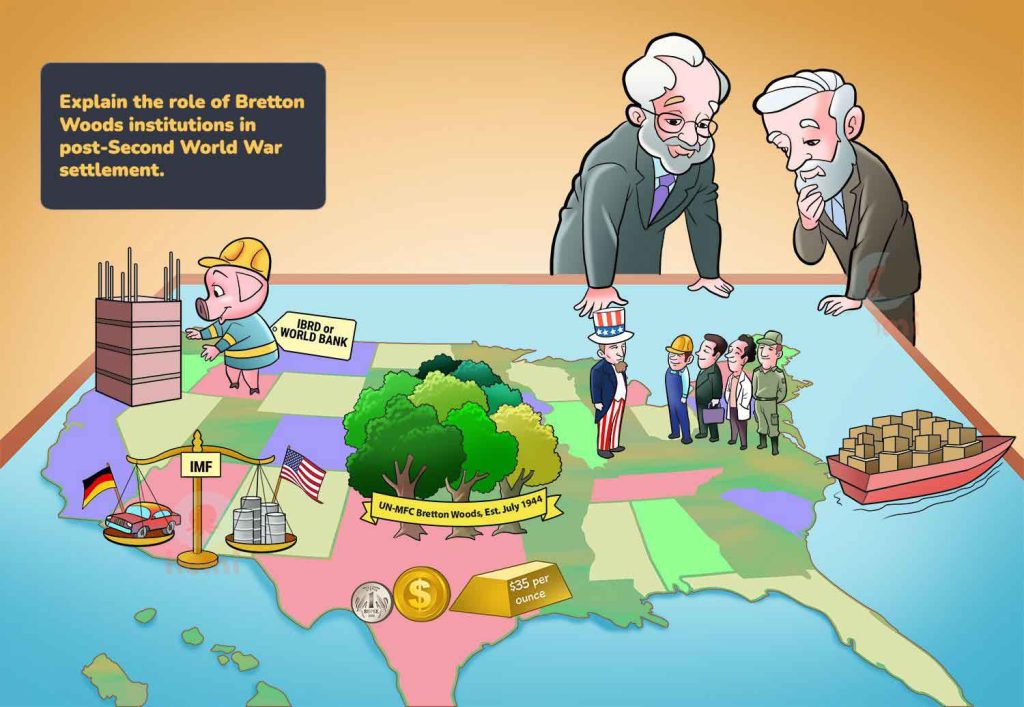

Delve into the intricate world of global finance with our comprehensive exploration of the World Banking Economy. Our journey commences at the Bretton Woods Conference, a pivotal event in 2023 -2024, where luminaries like Harry Dexter White laid the foundations for institutions like the IMF.

In the post-Bretton Woods era, nations grappled with economic shifts, particularly the unpegging of the U.S. dollar by President Nixon in 1971. This monumental decision reshaped international bank relations and set the stage for a dynamic new global economic landscape.

At the core of this system is the International Monetary Fund (IMF), tirelessly working to maintain economic stability. From providing short-term loans to influencing global trade, the IMF’s role has evolved to address a spectrum of economic challenges, ensuring adaptability in an ever-changing world.

In stark contrast, the World Bank adopts a long-term approach, focusing on sustainable development and poverty alleviation. Through lending arrangements with countries like Greece and Portugal, the World Bank plays a vital role in fostering economic growth while prioritizing human rights and environmental sustainability.

Together, the IMF and the World Bank emerge as pillars of global economic stability, navigating historical agreements and contemporary challenges. Join us in decoding the complexities of the World Banking Economy, where resilience and inclusivity shape the economic destiny of nations.

1. Decoding the World Banking Economy

The world banking economy, intricately tied to historic agreements and responsive to contemporary challenges, remains a linchpin of global economic stability. In this series, we embark on an exhaustive exploration of the World Banking Economy, tracing its roots from the pivotal Bretton Woods Conference to the multifaceted activities of the International Monetary Fund (IMF) and the World Bank.

I. Foundations of the World Banking System

The Bretton Woods Conference of [Year] marks a watershed moment, with visionaries like Harry Dexter White and the UK’s Treasury Representative shaping the foundations of the world banking system. This section delves into the historic agreements, the birth of institutions like the IMF, and the setting of the stage for the post-Bretton Woods era.

II. Post-Bretton Woods Era: Navigating Global Economic Shifts

In the aftermath of the conference, the world faced significant economic shifts. Unstable currencies and President Nixon’s decision to unpeg the dollar reshaped global economic dynamics. This segment unravels the intricacies of these events and their lasting impact on international bank relations.

III. International Monetary Fund (IMF): Safeguarding Global Economic Stability

At the core of the global financial system, the IMF plays a pivotal role in maintaining economic stability. This section explores the IMF’s mission, from providing short-term loans to addressing specific economic issues with attached conditions. We also scrutinize its influence on global trade and its evolving role in the changing economic landscape.

IV. World Bank: Nurturing Sustainable Development

In stark contrast to the IMF’s short-term focus, the World Bank adopts a long-term approach. This part outlines the World Bank’s main goals, including alleviating poverty and funding specific projects that contribute to global development. It sheds light on the institution’s impact on countries, examining lending arrangements and their role in fostering economic growth and stability.

2. Post-Bretton Woods Era: Navigating Global Economic Shifts

In the aftermath of the Bretton Woods Conference, the world encountered profound economic shifts that echoed across nations. Unstable currencies became a pressing concern, and the decision by President Nixon to unpeg the dollar marked a pivotal moment in global finance. This section unravels the intricacies of these events and explores their lasting impact on international bank relations.

Unstable Currencies and Heated Negotiations

The post-Bretton Woods era witnessed a surge in concerns regarding unstable currencies. Nations engaged in heated negotiations to stabilize their economic foundations, grappling with the challenges posed by fluctuating exchange rates. This period marked a crucial juncture where the international community confronted the complexities of managing diverse and often volatile monetary systems.

President Nixon’s Historic Decision: Unpegging the Dollar

A seismic shift occurred when President Richard Nixon made the historic decision to unpeg the U.S. dollar from the gold standard in 1971. This move, commonly known as the Nixon Shock, dismantled the established international monetary system. The repercussions were far-reaching, reshaping the global economic landscape and prompting nations to reassess their economic strategies.

Repercussions on International Bank Relations

The decision to unpeg the dollar had a profound impact on international bank relations. The dynamics of global trade, investment, and financial cooperation underwent significant transformations. Nations had to adapt swiftly to the new reality, navigating a landscape where traditional monetary norms were replaced by a more fluid and interconnected system.

Setting the Stage for a New Era

The events following the unpegging of the dollar set the stage for a new era in global finance. Countries began to explore alternative economic strategies, and international institutions, particularly the IMF, played a crucial role in facilitating economic stability amidst the evolving landscape. The challenges posed during this period laid the groundwork for a more interconnected and dynamic world banking system.

3. International Monetary Fund (IMF): Safeguarding Global Economic Stability

At the core of the global financial system, the International Monetary Fund (IMF) plays a pivotal role in maintaining economic stability. This section delves into the IMF’s mission, its multifaceted approach to global economic challenges, and its evolving role in the ever-changing economic landscape.

IMF’s Core Mission: Maintaining Economic Stability

The primary mission of the IMF revolves around maintaining global economic stability. This involves a nuanced understanding of economic policies and their impact on individual nations and the interconnected global economy. By providing member countries with financial resources and policy advice, the IMF aims to mitigate economic crises and promote sustainable growth.

Providing Short-Term Loans and Addressing Specific Economic Issues

One of the IMF’s key functions is to provide short-term financial assistance to member countries facing balance-of-payments problems. This assistance comes with attached conditions aimed at addressing specific economic issues. These conditions often involve policy adjustments and structural reforms designed to restore economic stability and pave the way for long-term growth.

Influence on Global Trade and Social Impacts

The IMF’s influence extends beyond traditional banking functions. It actively encourages global trade by fostering economic stability among its member countries. As countries implement IMF recommendations, the social impacts of these policies come to the forefront. Balancing economic adjustments with social considerations remains a critical aspect of the IMF’s efforts to create a sustainable and inclusive global economic environment.

Evolving Role in the Changing Economic Landscape

The IMF’s role has evolved over the years to meet the challenges of a dynamic economic landscape. From its founding focus on exchange rates and monetary cooperation, the IMF now addresses a broader range of issues, including fiscal policies, financial sector stability, and social safety nets. The institution continues to adapt its strategies to address emerging economic challenges and ensure its relevance in a rapidly changing world.

4. World Bank: Nurturing Sustainable Development

In stark contrast to the IMF’s short-term focus, the World Bank adopts a long-term approach, focusing on nurturing sustainable development globally. This section delves into the World Bank’s primary goals, its impact on member countries, and its crucial role in fostering economic growth and stability.

World Bank’s Main Goals: Alleviating Poverty and Funding Specific Projects

The World Bank’s overarching goals revolve around alleviating poverty and funding specific projects that contribute to sustainable development. By providing financial and technical assistance to developing nations, the World Bank aims to create conditions for economic growth and improve the quality of life for people in these regions.

Impact on Countries: Lending Arrangements and Economic Growth

The World Bank’s impact on member countries is evident in its lending arrangements and financial support. Lending projects are designed to address a wide array of challenges, from building critical infrastructure to supporting education and healthcare initiatives. Countries, including Greece, Ukraine, and Portugal, have benefitted from World Bank support, fostering economic growth and stability.

Striking a Balance: Long-Term Approach and Human Rights

Central to the World Bank’s mission is its commitment to a long-term approach that ensures sustainable development. This involves not only economic considerations but also a focus on human rights. The World Bank works closely with member countries to design projects that promote social inclusion, gender equality, and environmental sustainability, recognizing the interconnectedness of economic and social progress.

Shaping a Resilient and Inclusive Global Economy

As we conclude our exploration of the World Banking Economy, the combined efforts of the IMF and the World Bank emerge as pivotal forces shaping the economic destiny of nations. From historical agreements to modern challenges, these institutions play a crucial role in steering the global economy towards resilience and inclusivity.